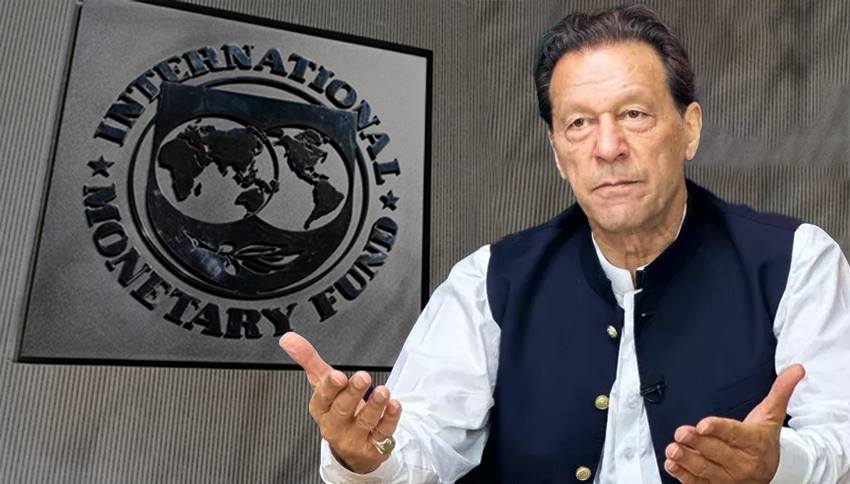

Pakistan secures IMF loan

3 min read

Navigating Economic Reforms: Pakistan’s Path After the IMF Loan. This topic could explore the potential economic reforms that Pakistan might undertake following the IMF loan agreement. Pakistan secures IMF loan it can delve into the challenges and opportunities that lie ahead in implementing these reforms.

The Role of International Aid in Pakistan’s Economic Development:

This topic would examine how international aid, including loans from institutions like the IMF, contributes to Pakistan’s economic development. It could also discuss the implications of such aid on the country’s policy-making and sovereignty. These topics offer a broader perspective on the impact and significance of the IMF loan for Pakistan, providing a platform for a comprehensive discussion on the country’s economic trajectory. In a significant move, Pakistan has secured a loan from the International Monetary Fund (IMF). This financial assistance is a testament to the country’s efforts to stabilize its economy. The IMF’s support comes at a crucial time when Pakistan faces economic challenges. The loan agreement with the IMF is a reflection of Pakistan’s commitment to economic reforms. The government has been working tirelessly to meet the IMF’s requirements for fiscal discipline. This loan is expected to pave the way for further financial aid from other institutions. Pakistan’s economy has been under pressure due to various internal and external factors. The IMF loan is seen as a lifeline that could help the country overcome its immediate financial woes. It is an opportunity for Pakistan to implement necessary reforms and strengthen its economic foundations. The IMF loan will also have a positive impact on Pakistan‘s international standing. It sends a strong signal to investors and international markets about Pakistan’s economic potential. The loan is not just financial support; it is a vote of confidence in Pakistan’s economy. However, securing the loan is just the first step.Pakistan secures IMF loan the real challenge lies in effectively utilizing the funds to achieve sustainable growth. Pakistan must ensure that the loan is used for developmental projects and not just for debt servicing. The terms of the loan require Pakistan to undertake stringent economic measures. These include reducing fiscal deficits, improving tax collection, and controlling inflation. The government must balance these measures to avoid any adverse impact on the common man. The IMF loan also comes with expectations of transparency and accountability. Pakistan must demonstrate that it is using the funds responsibly. This will be crucial for maintaining the trust of international lenders and the Pakistani public.

Critics argue that IMF loans often come with tough conditions that can be hard to meet. They worry that the austerity measures could lead to social unrest. However, supporters believe that these conditions are necessary for long-term economic health. The success of the IMF loan will depend on Pakistan’s ability to implement reforms. The government must work closely with the IMF to ensure that the program stays on track. It is a delicate balance between meeting IMF conditions and ensuring economic stability. more read here. In conclusion, the IMF loan is a pivotal moment for Pakistan‘s economy. It offers a chance to address structural issues and lay the groundwork for prosperity. With prudent management, Pakistan can turn this opportunity into a turning point towards economic resilience. This essay highlights the importance of the IMF loan for Pakistan’s economic future. It underscores the need for careful planning and execution to maximize the benefits of this financial assistance. Pakistan’s journey towards economic stability is challenging, but with the right steps, it can achieve success.